Greece plans four bond reopenings via auctions in the second half of the year to boost liquidity on the secondary market, its debt agency (PDMA) said on Tuesday.

The country has already achieved its 7-billion euro borrowing plan target this year through new bond issues and the reopening of other maturities but wants to facilitate investor demand as it aims to regain investment grade by the end of the year.

Greek bonds lost the investment credit rating in 2010, a year after Greece’s debt crisis broke out, forcing it to sign up to three international bailouts until 2018.

“The auction calendar is complementary to the Hellenic Republic 2023 funding programme, aiming at facilitating Greek government bonds’ secondary market operation,” the debt agency said. The agency usually raises small amounts through bond auctions, up to 400 million euros.

In its schedule released on Tuesday, the PDMA plans bond reopenings on July 19, Sept. 20, Oct 18 and Nov. 15.

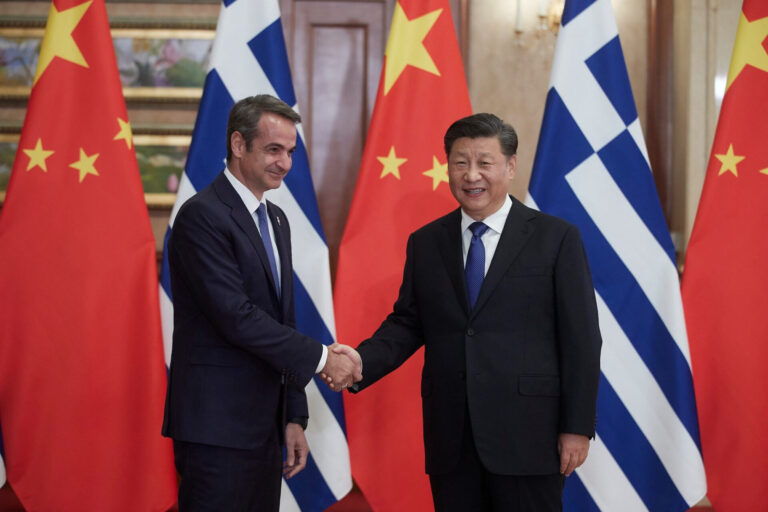

Greek 10-year bond yields GR10YT=RR have dropped since Monday after reformist Kyriakos Mitsotakis won a second term as prime minister following a resounding election win.

The PDMA has so far raised about 7 billion euros from a 10-year syndicated issue, a five-year bond and four bond sales earlier in the year.

Source: Hellenic Shipping News