China’s central bank unexpectedly lowered a key interest rate in a bid to invigorate an economy beset by a deepening property slump and lackluster consumer demand.

Data this week showed home prices in China fell for a second month in July, while industrial production and retail sales disappointed. After cutting rates on Tuesday by the most since 2020, the People’s Bank of China later in the week stepped up efforts to shore up an embattled yuan.

Meanwhile, economists are growing more upbeat about prospects for the US economy through 2024, according to a Bloomberg survey.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

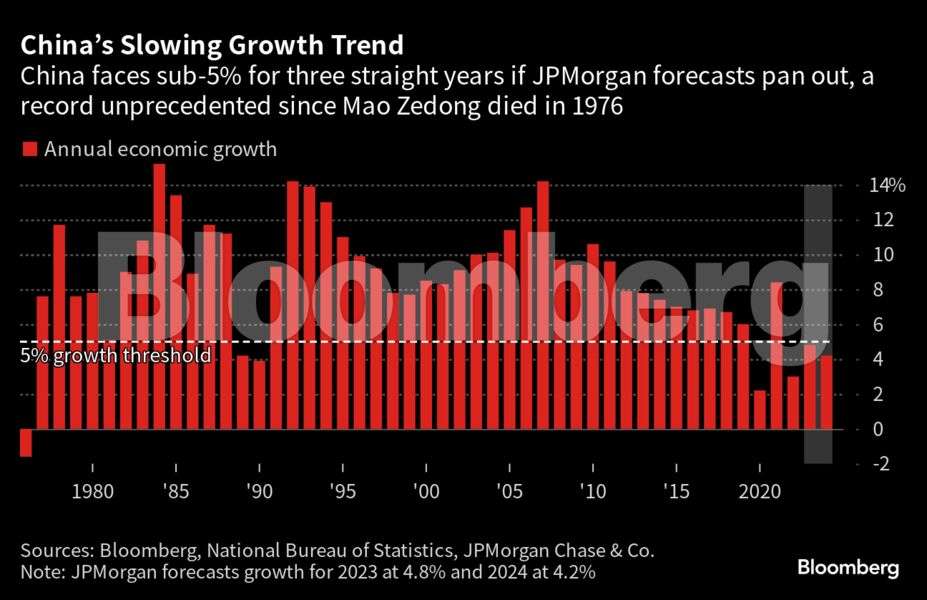

The bad news in China kept rolling in this week as data showed further signs of softening growth and evidence mounted that the property crisis — a years-long albatross for the economy — may be spreading to the financial sector.

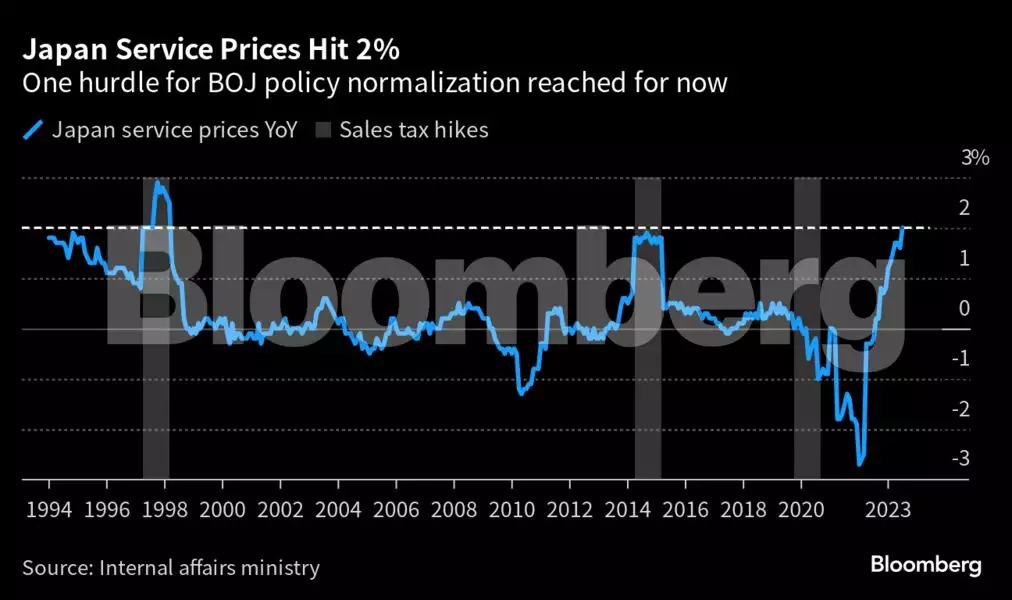

Japan’s price growth in services hit 2% in July for the first time in 30 years, a long-awaited development for the central bank as it waits for evidence of sustainable inflation before laying out a path toward policy normalisation.

Malaysia’s economic growth missed expectations in the second quarter of the year, expanding at the slowest pace in nearly two years on weakened global demand and the El Niño weather pattern. As trade-reliant Southeast Asian nations face external headwinds, they are increasingly looking to boost domestic consumption. The results have been mixed so far.

Taiwan’s economy is likely to grow less than 2% this year, according to the government’s latest forecast, in another sign the global electronics slump may persist longer than expected.

US

Economists see a stronger US economy into the next year and a smaller rise in unemployment, supporting expectations that the Federal Reserve will keep interest rates higher for longer.

US retail sales rose in July by more than forecast, suggesting consumers still have the wherewithal to sustain the economic expansion. The value of retail purchases increased 0.7% in July after upward revisions in the prior two months, Commerce Department data showed Tuesday.

The 30-year fixed mortgage rate rose to 7.16% last week, matching the highest since 2001 and crimping both sales and refinancing activity. A measure of mortgage applications for home purchases slid to the second-lowest level since 1995.

Europe

UK inflation remained higher than expected last month as the cost of travel and holidays climbed, adding to the case for the Bank of England to raise interest rates again. The Consumer Prices Index rose 6.8% in July, exceeding the 6.7% rate projected by economists. It was the fifth time in six months the figures surprised on the upside. Inflation remains more than triple the BOE’s 2% target.

A dearth of skilled labor that’s restraining German output is getting worse. A growing number of companies across Europe’s largest economy are short of such staff. More than 43% of the approximately 9,000 firms polled reported suffering from a lack of qualified workers in July — up from just over 42% in April. The all-time high of almost 50% was reached in July 2022.

Emerging Markets

Colombia’s economy contracted more than expected in the second quarter, increasing expectations of interest rate cuts over the coming months. All of Latin America’s major inflation-targeting economies are forecast to cut interest rates in the coming months as growth and inflation cool across the region.

Turkey’s inflation outlook is worsening due to a weak currency, with a key survey by the country’s central bank showing analysts expect the fastest predicted price gains in more than two decades.

World

In addition to China’s surprise reduction in rates, Uruguay delivered a bigger-than-expected cut and New Zealand held steady. Russia’s central bank raised interest rates sharply and said another increase is possible at an emergency meeting called to stabilise its currency. Norway took its deposit r ..

Source: Economic Times