In the dynamic arena of global shipping, BIMCO’s latest report reveals a tale of two nations: Greece, steadfast at the helm of the world’s cargo-carrying fleet, and China, swiftly ascending the ranks to maritime prominence.

Despite widespread consolidation within the container shipping sector, the broader market remains notably fragmented, with the majority of shipping companies possessing only a modest number of vessels. Throughout the ebb and flow of global trade, Greece has consistently held its position as the premier shipping nation.

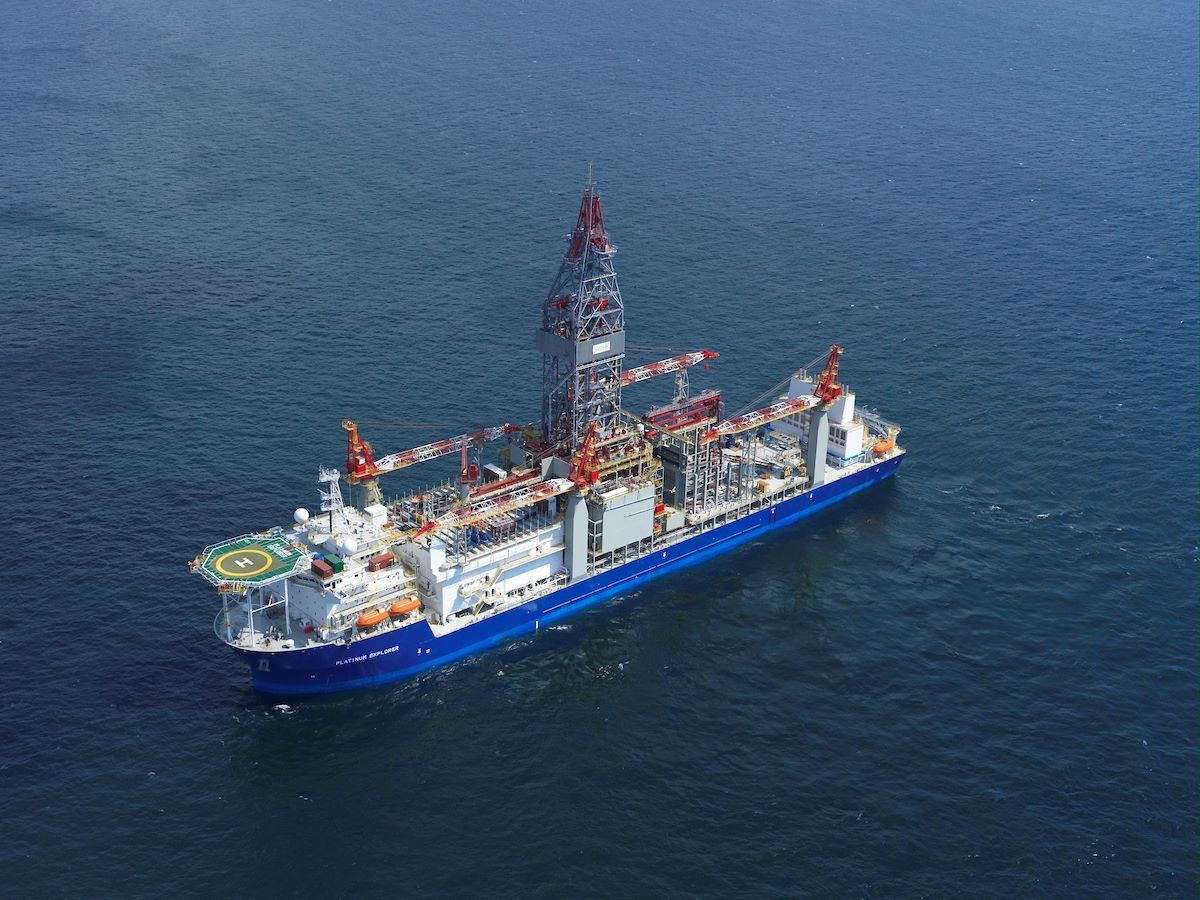

The current landscape, however, is witnessing China’s escalating influence in the maritime sector, with Chinese shipowners now at the helm of the world’s most extensive merchant fleet. Additionally, China boasts the second-largest fleet of cargo carriers. Greek shipowners, by measure of cargo capacity, are unrivaled, commanding 19% of the world’s tonnage and dominating sectors such as dry bulk, tankers, and gas carriers.

Chinese shipowners, however, have carved out their niche by securing a greater proportion of the general cargo and container fleets, thanks in part to the giant COSCO Shipping. A notable shift in the industry has been the entry of Chinese financial institutions into ship leasing, propelling the expansion of China’s fleet. Remarkably, five of the top ten Chinese shipowners are leasing companies, together managing 41% of the national fleet.

In contrast, the top ten Greek shipowners, who do not feature a single dominant player, are traditionalists in their approach. Seven among them boast fleets surpassing 10 million deadweight tonnes—a scale that only three Chinese counterparts can claim.

Despite the smaller number of major players, Chinese shipowners are setting the pace with a 21% larger order book than their Greek counterparts, signaling potential for more rapid fleet expansion. While Greek owners frequently engage in the second-hand market, the burgeoning order books of Chinese owners, particularly in the booming LNG and Pure Car Carriers (PCC) segments, suggest they might outstrip Greek growth in the years to come.

Both nations are investing heavily in LNG carriers and PCCs, with the Chinese holding the most substantial orders—126% and 260% of their current fleet in these categories, respectively. This strategic move aligns with the sectors’ robust expansion, indicating that the race for maritime supremacy is as much about foresight as it is about fleet size.

Source: Oil & Gas